How GBP & EUR Impact $BTC Bids

Delve into what’s happening, why, and how this leads to an increase in $BTC bids

As we know, inflation in the United Kingdom and Europe has significantly impacted everyone. It has produced many knock-on effects for the average person and investor. Let’s delve into what’s happening, why, and how this leads to an increase in $BTC bids.

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let’s dive in!

This narrative begins with the pandemic in 2020; markets initially crashed due to the fears of lockdowns and economic slowdowns. As a result, central banks and governments in the UK and Europe used monetary and fiscal policies to create an economic climate that promoted growth and gain.

One common way is quantitative easing, when the central bank purchases treasury bonds and print money against them to fuel the economy. This is great for markets because it injects liquidity. It causes pumps, but this is also bad for the currency if uncontrolled, as it is inflationary (supply goes up and price falls).

Qualitative easing (QE) was something both the UK and Europe did uncontrolled during the pandemic. For example, The Bank of England (BOE) has done £895bn in QE from 2009 (global financial crisis) to 2021 (a year after the first COVID-19 outbreak).

The European Central Bank (ECB) ran multiple-asset purchasing programs until late 2021, spending approximately €2.3Tn from 2017 to 2021. Another cause of massive inflation in the UK and Europe was Vladimir Putin's war on Ukraine. The battle between Russia and Ukraine has been raging since February 2022. In addition to the devastation Putin’s army has caused, Russia is also causing inflationary pressure on the rest of the world due to the sanctions NATO nations placed on Russia to weaken their economy so they would stop the war. Russia accumulated heaps of gold in preparation for this, so they’ve been able to survive.

These sanctions involved punishment of Russian Oligarchs, e.g., Roman Ibrahimovic having his house seized and bank account frozen. Sanctions were also placed on oil exports, and countries like Germany and Italy stopped buying oil from the Russians. In retaliation, Russia stopped exports. The main exports were iron, wheat, and oil & petroleum. The contraction in the supply of these commodities in the global economy caused prices to be pushed up as the demand remained constant; this is demand-side inflation. This type of inflation is a bit more complex to reverse as the war would need to end, Russia would need to be willing to begin trading with the world again, and NATO would have to lift sanctions.

In addition, Russia has retaliated by only selling their resources in roubles – this forces anyone who wants to buy from them to use their currency, making it more valuable, which is what the UK and Europe want to avoid. European countries under NATO refused to buy roubles, so they had to look to alternate sources of oil and energy, such as the UK’s Brent crude oil. Europeans needing to use the UK’s authority has caused prices to go up, leading to the spillover inflationary impact we’re experiencing.

In response, the BOE and ECB naturally resorted to reversing monetary policy decisions and making new ones to tighten the economic environment. Lowering inflation is done in two ways, raising interest rates and selling assets. Increasing rates makes borrowing more expensive, so people borrow less, resulting in less money flowing in the economy. Therefore, prices must decrease for businesses to drive sales to continue operating and for consumers to afford their needs.

The second way is selling assets, often referred to as quantitative tightening, the opposite of QE. Assets are sold, and loans are paid back, causing currency supply to fall and the value to rise. Both are effective ways of bringing inflation down, which the ECB & BOE are using.

Still, the war in Russia needs to end/settle, and Russia needs to reverse its decision for the bulk of inflationary pressure to be lifted. So it’s a waiting game for the UK and Europe to see what works first and when the war will end.

That sums up everything on the macro side of things; however, how can we draw this mess to the crypto markets?

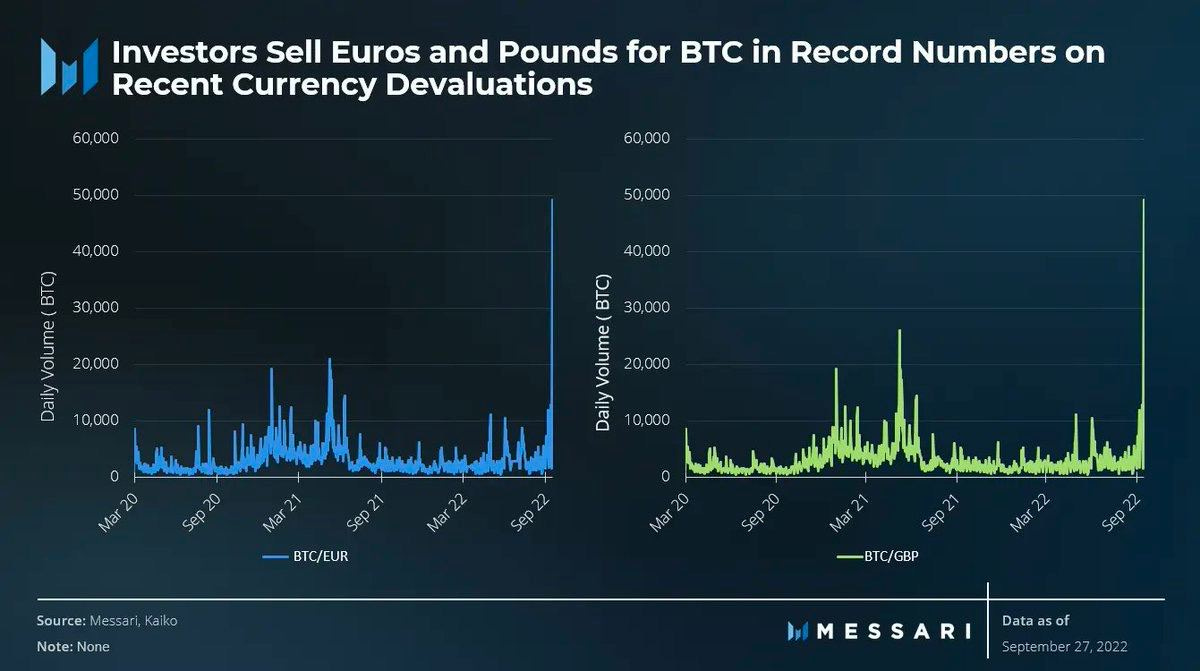

As highlighted in the graphic above, we can see that investors selling Euros & Pounds for $BTC have increased in record numbers. In 2022 alone, we have seen the extent of the coupling between crypto and the macroeconomic environment.

Do investors value $BTC more than $EUR & $GBP? In previous years, there hasn’t been a viable alternative option that investors can get behind to hedge their losses in innovative technology. This is hypothetical, as there is no exact measurement of why people are selling, but if we apply the logic from the start of the year, we have seen all asset classes crash.

However, crypto has shown more strength than some markets, which could rewrite the expected association between crypto and extreme volatility. With crypto falling less sharply than other asset classes, investors may consider moving a portion of their fiat investments into crypto, which has already shown its ability to alleviate the bearish momentum of other markets.

Subscribe to receive our weekly newsletter and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.