DeFi Safety : Protecting Your Crypto from Rugs and Hacks🦺

Learn about two tools that can help you avoid the risks of DeFi and keep your crypto safe

You must be living under a rock if you think safety isn't that big a problem in crypto. Crypto/DeFi has loads of protocols and projects worth exploring - but that shouldn't come at the expense of safety.

Crypto's recency allows authorities to turn a blind eye, as most of the regulation is unclear and allows rugs & hacks to occur without much repercussion.

A significant example of why safety is more relevant than ever in DeFi is the North Korean hacking cybercrime group called Lazarus, which is reportedly state-owned and trying to facilitate large-scale hacks.

In this article, we'll cover two DeFi safety tools that conduct risk assessments for protocols. These tools can be helpful to:

Save time 🕔

Adapt your risk management strategy 🛡

As part of our conclusion, we'll revisit the use cases for each tool.

Tool # 1 - RugDoc⛑

RugDoc is a search engine that lets you filter and browse through different blockchain protocols and analyze their risks. It has many subcategories, such as NFTs, Farms, and Tokens, that you can use to assess the risks of different DeFi projects.

As you can see, there are different risk tolerances.

You can align your risk appetite with the risk ratings provided on the platform when looking for somewhere to generate profits.

For example -

If you're looking for a protocol to hold your $USDC, you would want the least risk possible.

Conversely, if you're looking for more risk, you can accommodate it through the platform.

Below is a helpful graphic, also found on the website, which explains each risk rating. Additionally, you can filter through audited and KYC projects.

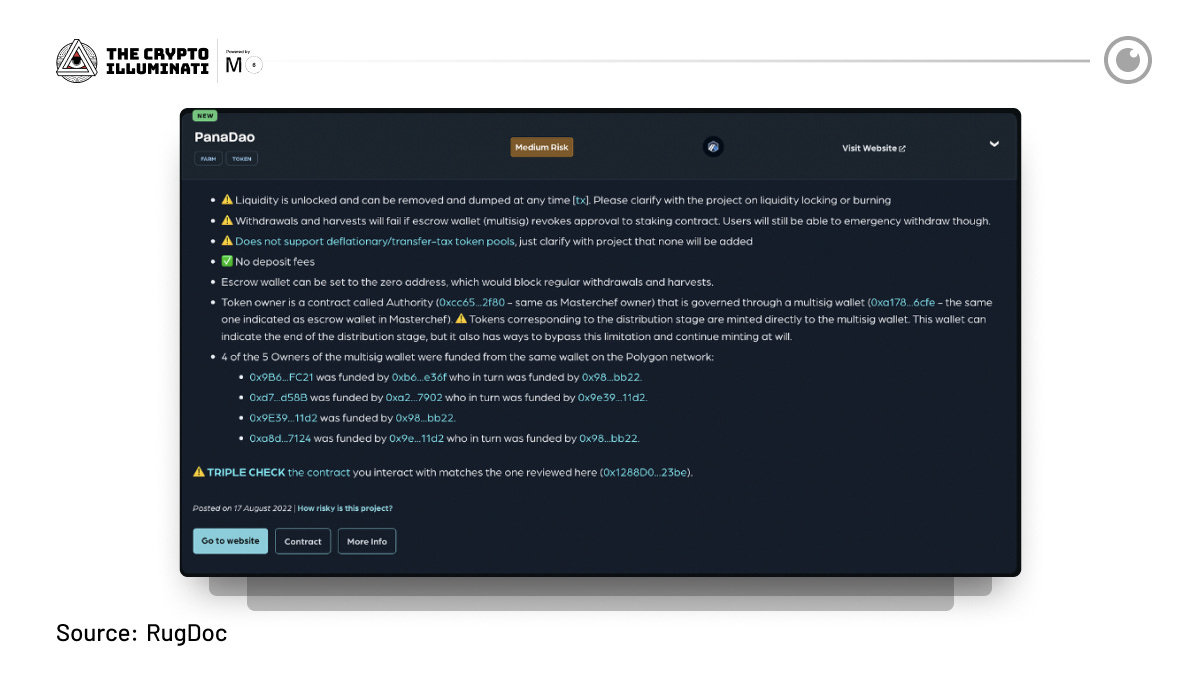

The best part about RugDoc is that when viewing a project that fits your criteria in terms of chain and product, there is an incident report on the project with warnings and smart contract details.

RugDoc also analyzes wallet behavior for some of the top whales; this is a crucial part of DeFi safety. If the big wallets are bad actors, it can impact the security of a protocol.

This is an example of the risk reports that RugDoc provides. They are instrumental in giving you all the information you need before involving your capital in a protocol.

You can find RugDoc here: RugDoc⛑

Tool # 2 - DeFiSafety👨🔬

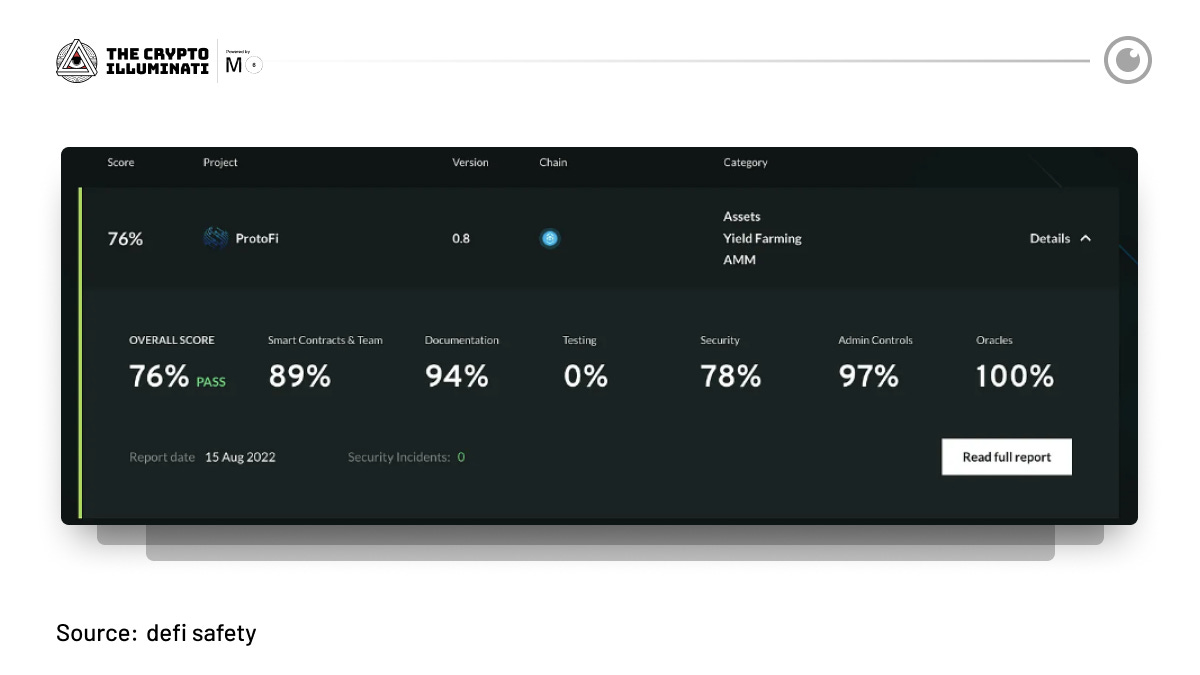

DeFiSafety is another safety tool that is a rating system for DeFi protocols. It covers 17 chains with over 260+ protocol reviews and is trusted by reputable names like Nexo, CoinGeko, and DefiYield.

DeFiSafety gives protocols a score based on their risk and has a pass/fail criteria for their security ratings. It also provides an overall safety score rating based on several factors that should be considered when interacting on-chain, but are often ignored:

Smart Contracts & Team

Documentation

Testing

Security

Admin Controls

Oracles

Similar to RugDoc, DeFiSafety also has security incident reports that show how many breaches a protocol has had.

Once you expand a project that interests you, there is a list of questions for each contributing factor that determines the final overall rating, called the "scoring appendix".

In my opinion, this is one of the most valuable tools in crypto.

What’s The Point Of This ?🤷

We need to be careful when it comes to DeFi because it can be risky in many ways.

Examples are the “whole node season” or “staking tokens” - stuff that we shouldn’t go near without proper risk assessment. The tools discussed above can help with this through simple means that take care of ALL the risk assessments we SHOULD take before investing or interacting with something in DeFi.

Revisiting my points in the introduction, these two tools have these key benefits - they can help you to

Save time : You can save time by using tools that manage risk and carry out all of the risk questions that DeFiSafety uses, for example. It's much harder to do this yourself.

By cutting down on the time needed to research the safety of a protocol, you can focus instead on other areas of research and due diligence where you may have more expertise.

Adapt your risk strategy : By using tools that aggregate the overall safety of a protocol, you can be adaptive with your risk strategy in different market environments.

The idea is to let the tools do the heavy lifting in risk analysis for you - and to make sure nothing slips through the cracks. This makes it much more likely for you to enjoy success in your crypto/DeFi investment journey!

Subscribe to receive our weekly newsletter and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.