Blur Overview

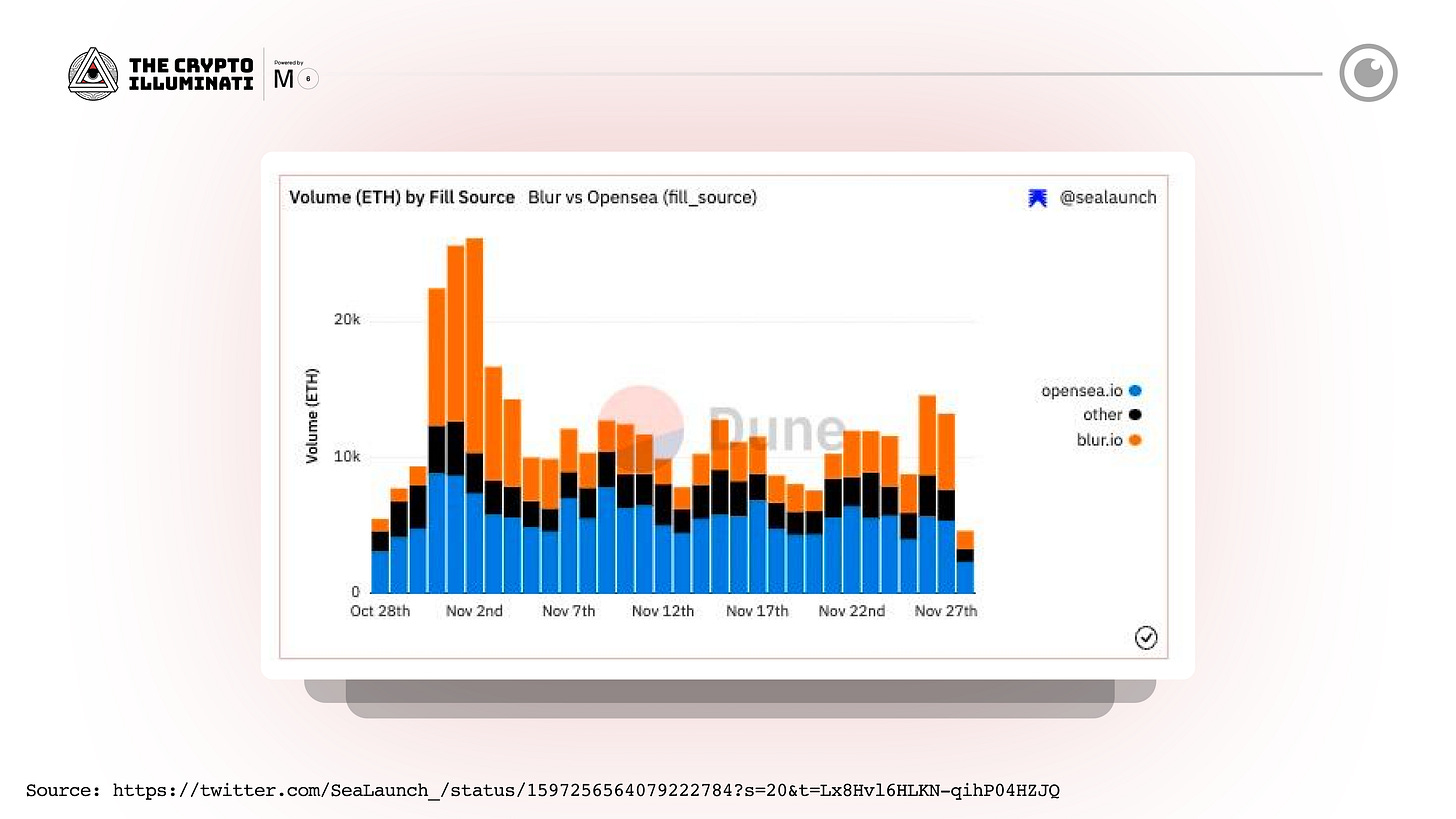

On November 27, Blur surpassed Opensea in terms of the trading volume. Many new NFT marketplaces have been created recently, but none with the intention of domination...until now

The current NFT marketplaces focus too much on the retail experience and not enough on professional traders. Blur is working to solve these issues and move the NFT space towards institutionalization while increasing decentralization.

Blur's background

Blur is a new NFT marketplace that has been backed by well-known investors such as Paradigm, 6529, Cozomo Medici, and Bharat Krymo. The team comprises developers from renowned organizations such as MIT, Citadel, Five Rings Capital, Twitch, Brex, Square, and Y Combinator.

The new marketplace was in a private development phase for approximately 276 days before officially launching on October 19, 2022. Blur’s aggregator already has the second-highest volume in the space: Blur celebrated the milestone on Twitter, saying that it "became the #2 NFT marketplace by volume (excluding wash trades)!" as well as the "#1 aggregator" for NFTs.

Royalty mechanism and fee structure

Blur has no marketplace fees, so you can make as many trades as you want without worrying about any commission. In addition, the advanced trading tools on Blur are also free for users. Traders are encouraged to set royalties above zero, so they have the potential to earn more rewards through incentivized airdrops.

Blur's royalty system is unlike most NFT marketplaces. Here, NFT traders set their own royalties, which means the original creator doesn't earn any revenue from secondary sales if traders don't pay royalties. However, the incentive program benefits traders who use royalties: For example, those who pay higher rates will get more airdrops.

It's important for traders to understand that those who set their royalties above 0.5% will receive a larger airdrop than those sticking with the base rate of 0.5%.

Blur is a marketplace and aggregator in one

A comprehensive comparison of NFT aggregators, including Blur, has yet to be completed. According to data from Blur's private beta transactions, the company claims that its transactions are ten times faster than Gem's.

According to a recent tweet from the Blur team, they are the largest aggregator by volume.

Blur is intended for professional traders, similar to other aggregation services. Floor-sweeping, buying numerous NFTs in a solitary transaction, is an everyday use case that necessitates fast transaction processing and avoiding fees, aside from bulk purchasing NFTs. This is typically done by whales and advanced traders before a project gains significant traction.

Blur’s airdrops

The two airdrops that Blur announced were the main reasons behind this growth. The first airdrop is of care packages that NFT traders have to claim within 14 days after the launch, and it is only available to those who traded in the last six months.

These packages include an unspecific number of BLUR tokens, which will be used as the governance token. In order to get these care packages, traders must list at least one NFT on the Blur marketplace. Users won't be able to access the rewards until January 2023, when the BLUR token becomes available.

In November, the second Blur airdrop occurred for active traders. According to the Blur team, if traders list NFTs from well-known and reliable collections, they will likely receive more valuable BLUR rewards.

Blur, once again, surpassed OpenSea's volume.

On 27 November, Blur passed Opensea in terms of volume with 5.5K ETH (Blur) vs. 5.3K ETH (Opensea).

Although OpenSea continues to dominate with more than 70% of the market share, Blur has attracted many active traders, suggesting a profound identification of value.

What’s The Catch?

According to user feedback, Blur's disadvantage is that it may not be as secure as it appears. A high level of trust is required for users to execute on marketplaces such as OpenSea or LooksRare. However, a Blur user discovered a significant issue with the app.

The problem is that the same lines of code in their system only show if the caller is allowed to transfer tokens, which means that the person who owns the smart contract can keep taking tokens and adding new addresses to the mapping.

As a recently established NFT marketplace, Blur doesn't have any guarantees yet.

Final Thoughts

Time will only tell what the future holds for this NFT trading platform, but Blur deserves credit for competing against industry giants like OpenSea. Its cutting-edge approach to supporting NFT trading is a major reason behind its success thus far.

Subscribe to receive our weekly newsletter and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.