A dive into why investor sentiment went left with $APTOS

Aptos is a Layer 1 blockchain developed using Move, a Rust programming language.

Aptos is a Layer 1 blockchain developed using Move, a Rust programming language. With a team of over 350 developers, Aptos aims to revolutionize the Layer 1 space with more efficient methods for consensus mechanisms, smart contracts design, enhanced security, improved performance, and decentralization.

While there was high anticipation for this new cryptocurrency, its trading debut shocked the online community on October 19, 2022. After listing in the $9 range, the native token declined significantly by over 30% within its first trading hour.

This article delves into why Aptos failed in its launch and further looks into investor sentiment after the event. By the end of this post, you will have a solid understanding of Apto’s recent happenings and what it means to investors.

Before we get started... Want early access to our research threads? Sign up to our Substack to receive daily coverage on everything you need to know about going on in the crypto directly in your inbox:

Done? Now let’s dive in!

Why Aptos Failed In its Launching

Transaction speed

Among the reasons for creating Aptos was delivering speed in handling transactions. Bitcoin runs seven transactions per second (tps). Ethereum is up to 30 tps. While other blockchains like Solana handle up to 3700 tps on downtime, Aptos claims to be three times faster.

The Aptos blockchain’s current tps is 4, lower than Bitcoin’s, which calls to question whether or not Aptos can handle the load associated with mass adoption. Most recent transactions on the network aren’t actual transactions; they are communication between validators, setting up block checkpoints, and metadata writing into the blockchains. The slow speed has been one of the most significant drawbacks accelerating the failure at launch.

Dodgey Tokenomics

Tokenomics play a significant role in influencing investors’ decision-making as they move forward with crypto projects.

It’s the convention of blockchain protocols to release the tokenomics before adopting the mainnet. In this case, Aptos did the complete opposite by publishing the $APT tokenomics hours after the launch. This order of events escalated fear and uncertainty in the community.

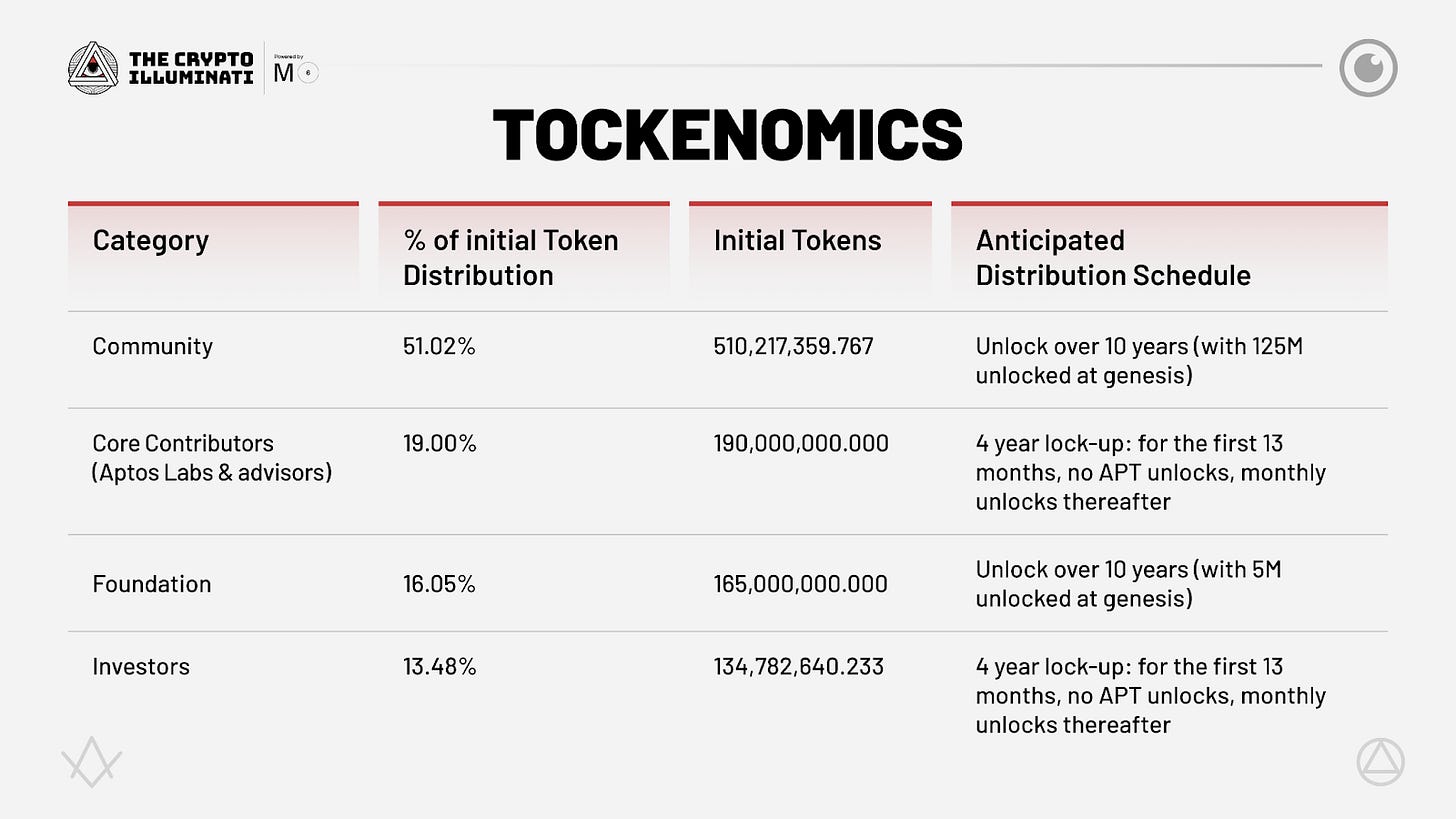

The Aptos tokenomics were not only availed at the wrong time but were also controversial. Aptos received critique regarding the amount of $APT private investors hold. Here is a breakdown of $APT distribution according to the Aptos Foundation.

Total supply – 1 billion distributed as follows:

165 million tokens go to the foundation and will be distributed over ten years. The average of 5 million is enough to support Aptos initiatives in the foundation docket. 125 million $APT can help the ecosystem’s projects, grants, and potential community growth initiatives. The community is unhappy about this allocation scheme.

The Effect on Investor’s sentiment

Following the recent underperformance of Aptos, the question is, “Is Aptos a good investment?” The only one who can answer this question is you. Mo Shaikh is clearing the bad press by announcing NFT marketplaces. Recently, NFTs have been a hot item in crypto despite the market’s volatility. Aptos developers are optimistic about the success of its NFT marketplaces. This developmental move could showcase Apto’s scalability potential.

Investors are worried about Aptos’ promises. Shaikh defends the project and asserts that the low tps is associated with a lack of projects on the network. He further explains that the project will showcase its capabilities with increasing activity.

As users flock to the NFT marketplaces, the Aptos network will undergo a test. Until then, the network is battling significant controversy, like nearly half of the total $APT supply being airdropped to its developers and early investors – FTX and Andreessen Horowitz.

Final Thoughts

Like with other crypto projects, investors should allocate ample time to research before investing. History has proven that VC firms dump their holdings soon after the project’s launching. Aptos is backed by some prominent investors like PayPal and Coinbase. Every move made by Aptos is under the community’s watch. Aptos needs to stay innovative and transparent to achieve its goal of becoming the home of Web 3.

Subscribe to receive our weekly newsletter and in-house research content!

Please Share, Leave Feedback, and Follow Us on Twitter, Telegram, and LinkedIn to stay connected with us.